AB 2243 Amendments to Streamlining Tools for Residential Development on Commercially Zoned Properties Are Now In Effect

Assembly Bill (“AB”) 2243, which expands existing streamlining tools for residential developments on commercially zoned properties, took effect on January 1, 2025. AB 2243 makes significant revisions to AB 2011 (the Affordable Housing and High Road Jobs Act of 2022), which is the principal focus of this alert. AB 2243 also includes a change to Senate Bill (“SB”) 6 (the Middle Class Housing Act of 2022). Each of these bills went into effect on July 1, 2023, and remain operative through January 1, 2033. For more information on AB 2011 or SB 6, see our prior legal alert available here.

Recap of AB 2011

Under AB 2011, qualifying 100% affordable housing projects (“100% Affordable” projects) and qualifying mixed-income housing projects (“Mixed-Income” projects) located within a zoning district where office, retail, or parking are principally permitted uses are entitled to a streamlined, ministerial approval process, making the projects exempt from review under the California Environmental Quality Act (“CEQA”). The qualifying criteria vary based on whether the project is a 100% Affordable or a Mixed-Income project located along a commercial corridor, but in either case the project must meet affordability, prevailing wage, and commercial tenant relocation requirements. AB 2243 does not change AB 2011’s prevailing wage or tenant relocation requirements.

AB 2243 Amendments

AB 2243 amends AB 2011 with the intent to: (1) ensure more properties are eligible for the benefits of AB 2011, (2) modify some of the property and project criteria and restrictions to allow greater use of this streamlining tool, and (3) clarify certain provisions that proved difficult to interpret. One of AB 2243’s most impactful changes is the revision of the prior 20-acre maximum site criteria under both AB 2011 and SB 6 to allow development on sites up to 100 acres containing a regional mall, further incentivizing retail-to-residential conversions. Some of AB 2243’s amendments, however, narrow the classes of projects eligible for streamlining. These changes, and other notable amendments, are summarized below.

Looking Ahead

In the year and half since AB 2011 went into effect, we have not seen much use of this streamlining tool. With the passage of AB 2243, however, we are seeing increased interest and greater optimism for expanded opportunities for housing in commercial areas using this law. One of the original components of AB 2011 is the requirement that the California Department of Housing and Community Development (“HCD”) complete a study identifying the location and number of housing units built using this tool, among other data. The first of these reports must be completed by HCD by January 1, 2027, and will be available to the public.

Please contact an author of this alert or any member of the Cox Castle Land Use & Natural Resource Team if you have questions about AB 2243.

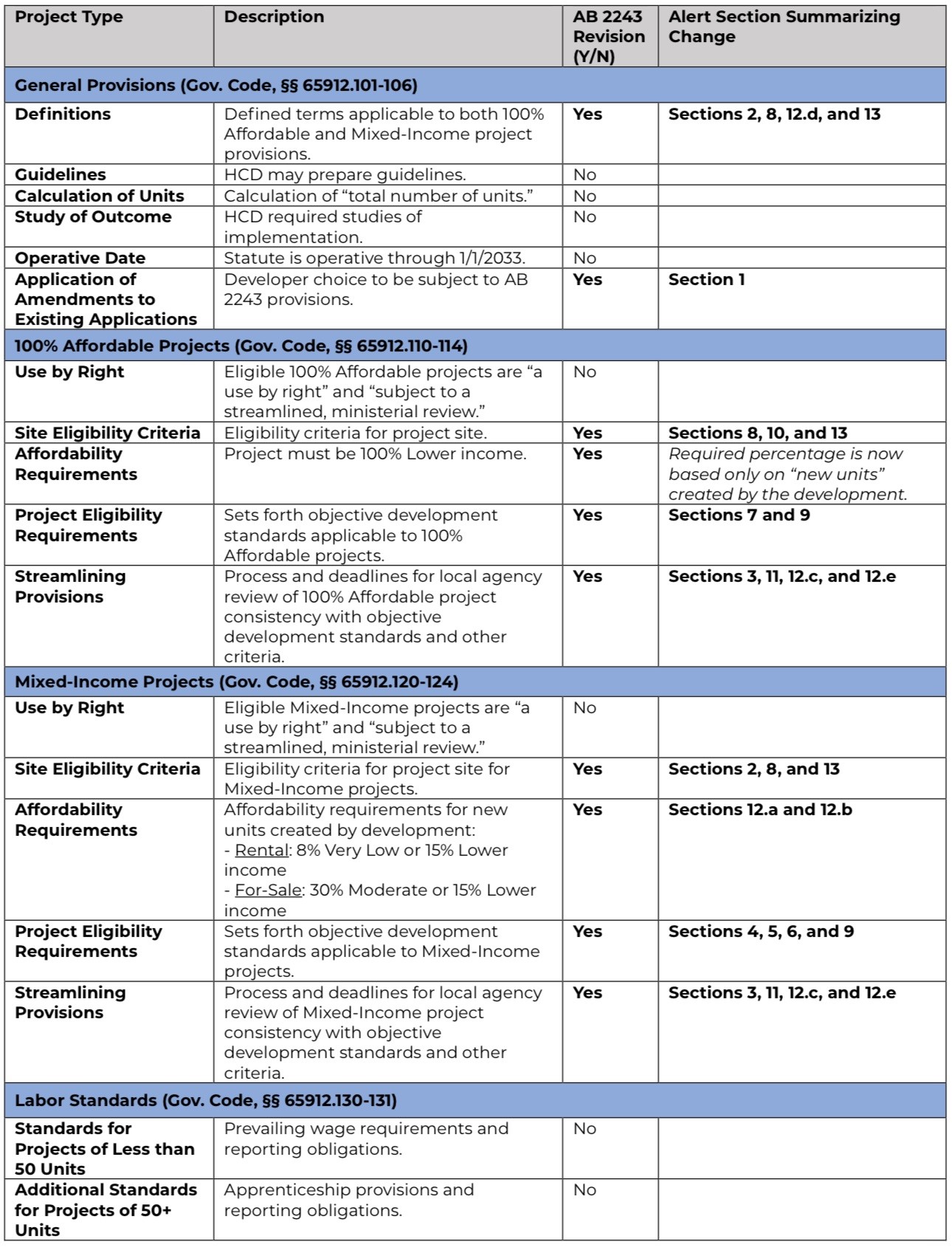

AB 2011 Components Amended by AB 2243

The table below identifies the core components of AB 2011, and the sections impacted by AB 2243 with specific revisions.

Summary of Key Amendments

AB 2011 contains separate streamlining provisions for 100% Affordable projects and Mixed-Income projects. AB 2243 includes amendments that apply to both classes of projects, as well as amendments applicable to only one or the other. Below is a summary of some of the more notable amendments.

1. Application of AB 2243 to Existing AB 2011 Applications: AB 2243 allows applicants for projects submitted before December 31, 2024, to choose to proceed pursuant to AB 2011 as it existed before AB 2234 or to be subject to any of the changes under AB 2234.

2. Expansion to Allow Redevelopment of Regional Malls: AB 2243 modifies AB 2011’s restriction to sites of “20 acres or less” by allowing a Mixed-Income project on site that is a “regional mall,” as defined, provided the “site is not greater than 100 acres.” To qualify as a regional mall, the site must meet all of the following criteria on the date the development proponent submits an application:

a) Permitted uses on the site include at least 250,000 sf of retail use.

b) At least two-thirds of the permitted uses on the site are retail uses.

c) At least two of the permitted retail uses on the site are at least 10,000 sf.

AB 2243 also amends SB 6’s 20-acre site restriction to allow development on a regional mall site of 100 acres or less. For more information on SB 6, see our prior legal alert available here.

3. Changes to Local Agency Processing Requirements and Timelines: AB 2243 revises AB 2011 to establish separate timelines for a local agency’s consistency determination and project approval. These deadlines apply to both 100% Affordable and Mixed-Income projects.

a) Consistency Determination. AB 2243 adds a new procedural step and timeframe for the local agency to make a determination as to the project’s consistency with the AB 2011 criteria. This determination must be made within 60 days (150 or fewer units) or 90 days (151+ units) of the submittal of the development proposal to the local government, and within 30 days of any applicant resubmittal. During any subsequent consistency review, the local agency is prohibited from requesting new information not requested in the initial determination. This consistency determination is distinct from the timelines and requirements for an “application completeness determination” required under other housing laws.

b) Project Approval. Under AB 2011, the local agency was required to approve the development within 60 days (150 or fewer units) or 90 days (151+ units) of “submittal of a development proposal.” AB 2243 revises this deadline to be counted from “the date that the development is determined to be consistent with the objective planning standards.”

4. Revisions to Mixed-Income Maximum Density Restrictions: For Mixed-Income projects, AB 2011 established maximum density restrictions (referred to as “allowable density”) for a project based on whether the project is within a metropolitan or non-metropolitan jurisdiction, the density allowed on the parcel by the local government, the size of the project site, the width of the commercial corridor, or proximity to transit. The statute provides that the greatest of the five applicable categories is the allowable density. AB 2243 revises these provisions to allow greater density for some sites.

a) AB 2243 revises the density category previously tied to “residential density allowed on the parcel by the local government” to instead incorporate the definition of “maximum allowable residential density” from the State Density Bonus Law (“SDBL”), which defaults to the greatest number of units allowed under the local zoning, specific plan, or land use element.

b) AB 2243 also revises the density category pertaining to proximity to transit. Under AB 2011, only projects within “one-half mile of a major transit stop” were eligible for the 70 units per acre (for non-metropolitan jurisdictions) or 80 units per acre (for metropolitan jurisdictions) density maximum. Under AB 2243, “sites within a very low vehicle travel area” also are eligible for these greater densities. AB 2243 defines “very low vehicle travel area” by reference to the Housing Accountability Act.

5. New Mixed-Income Minimum Density Requirements: AB 2243 adds new minimum density requirements for Mixed-Income projects, which will be implemented in two stages as follows:

a) Before January 1, 2027. For a housing development project application that is determined consistent with the objective planning standards before January 1, 2027, the project must be developed at a minimum density as follows:

- 50% or greater of the applicable allowable density (discussed above), excluding the maximum allowable residential density a defined under the SDBL; or

- 75% or greater of the applicable allowable density, excluding the maximum allowable residential density as defined under the SDBL, if the project site is within one-half mile of an existing passenger rail or bus rapid transit station.

b) On or After January 1, 2027. For a housing development project application that is determined consistent with the objective planning standards on or after January 1, 2027, the project must be developed at a density of 75% or greater of the applicable allowable density, excluding the maximum allowable residential density as defined under the SDBL.

c) Exception for Conversion of Existing Buildings: A development project shall not be subject to any maximum density limitation if it is a conversion of existing buildings into residential use, unless the development project includes new square footage that is more than 20% of the overall square footage of the project.

6. Objective Standards for Mixed-Income Projects: AB 2243 revises AB 2011’s provisions regarding the applicable objective zoning, subdivision, and design review standards. While AB 2011 provided that the applicable standards were those “for the closest zone” in the jurisdiction “that allows multifamily residential use” at the residential density allowed in AB 2011 (or “if no such zone exists” allowing such density, “the zone that allowed the greatest density within the municipality”), AB 2243 provides that the applicable standards are those for the closest zone in the municipality that allows multifamily residential use “at the residential density proposed by the project.” AB 2243 clarifies that the applicable objective standards for the closest zone in the jurisdiction that allows multifamily residential use exclude density, height, setback, and parking standards, which are prescribed in AB 2011. AB 2243 also provides that the “objective standards shall not preclude a development from being built” at the maximum allowable and minimum required densities in AB 2011 and “shall not require the development to reduce unit size to meet the objective standards.”

7. Objective Standards for 100% Affordable Projects: For 100% Affordable projects, AB 2243 clarifies that the “applicable objective standards shall be those for the zone that allows residential use at a greater density between” either (a) the existing zoning if it allows multifamily, or (b) the “closest parcel that allows residential use at a density proposed by the project.” Under AB 2011, the second criterion referred to the closest parcel allowing residential use at a density appropriate to accommodate housing for lower income households.

8. Sites with or Adjoining Industrial Uses: AB 2011’s site criteria contain restrictions for both 100% Affordable projects and Mixed-Income projects if the projects are on or adjoining a site where more than one-third of the site is “dedicated to an industrial use.”

a) Expanded Definition of “Industrial Use.” AB 2243 expands the definition of “industrial use,” which previously included only utilities, manufacturing, transportation storage, maintenance facilities and warehousing uses and specifically excluded power substations or utility conveyances such a power lines, broadband wires, and pipes. As revised, “industrial use” now also includes “any other use that is a source that is subject to permitting by” an air pollution control district or air quality management district. AB 2243 also adds two categories of uses as excluded from the definition: (1) a use where the only source permitted by a district is an emergency backup generator, and (2) self-storage for residents of a building.

b) Narrowed Definition of “Dedicated to Industrial Use.” Under AB 2011, “dedicated to industrial use” applied only where: (1) the square footage was currently being used as an industrial use; (2) the most recently permitted use of the square footage was an industrial use; or (3) the site was designated for industrial use in the latest version of the local government’s general plan adopted before January 1, 2022. AB 2243 modifies the second criterion, “most recently permitted use,” to include an additional requirement that the site has been occupied within the past three years. It also modifies the third criterion, “designated for industrial use,” to require that “residential uses are not principally permitted on the site.”

9. Developments Within 500 Feet of a Freeway: Under AB 2011, a project could not be located within 500 feet of a freeway. AB 243 permits both 100% Affordable projects and Mixed-Income projects located within 500 feet of a freeway as long as the projects satisfy specified air quality requirements.

10. Exclusion for 100% Affordable Projects on Historic Sites:AB 2243 revises AB 2011 to provide that 100% Affordable projects are ineligible if they require the demolition of a historic structure on a national, state, or local historic register. This restriction already applied to Mixed-Income projects.

11. Reduction in Fees: AB 2243 provides that the amount of a “fee” (as defined) imposed on either a 100% Affordable or a Mixed-Income project that demolishes or changes an existing use “shall be offset to account for the demolition or change so that the amount of the fee is attributable only to the development’s incremental impact on public facilities or services.” This provision applies to both generally applicable fees and fees imposed on a specific project on an ad hoc basis.

12. Relationship to Other Laws: Several of AB 2243’s provisions address the relationship between AB 2011 and other state laws and local requirements, as summarized below.

a) Local Inclusionary Obligations: AB 2243 clarifies the obligation of Mixed-Income projects to comply with local inclusionary obligations that differ from AB 2243 requirements. As revised, Mixed-Income projects must “meet the affordability level of a local affordable housing requirement if it is a deeper affordability level than required by” AB 2011. Previously, AB 2011 required the project to “meet the lowest income targeting in either policy.”

b) State Density Bonus Law: Because most AB 2011 projects will be eligible for SDBL benefits, AB 2243’s numerous clarifications pertaining to the SDBL are some of the more important changes to AB 2011.

- Maximum Density Does Not Include Bonus Units. For Mixed-Income projects, AB 2243 revises the calculation of maximum density to clarify that it is calculated prior to the award of any eligible density bonus under the SDBL.

- New Definition of “Base Units.” AB 2243 incorporates the SDBL definition of “total units” as the new definition of “base units,” clarifying that for purposes of calculating the affordability percentage for Mixed-Income projects, the calculation excludes density bonus units and includes units designated to satisfy a local inclusionary requirement.

- SDBL Benefits and Project Eligibility. AB 2243 clarifies that use of SDBL incentives, concessions, waivers or reductions of development standards, or parking ratios does not cause either a 100% Affordable project or a Mixed-Income project to be subject to a local discretionary review, nor does it provide a basis to find the project inconsistent with the local coastal program (“LCP”).

- Use of Incentives, Concessions, Waivers for Objective Standards. For Mixed-Income projects, AB 2243 clarifies that a development proponent may use incentives, concessions, and waivers or reductions of development standards under the SDBL to deviate from the objective standards for Mixed-Income projects for height and for some (but not all) setback requirements.

c. Housing Accountability Act (“HAA”): AB 2243 expressly provides that the HAA applies to eligible 100% Affordable and Mixed-Income projects.

d. Use by Right” and CEQA: AB 2243 revises the definition of “use by right” by clarifying that “[n]o aspect of the development project, including any permits required for the development project, is a ‘project’ for purposes of [CEQA].” For example, if an eligible project requires a subdivision map, the need for the map will not cause the project to be subject to CEQA. Similarly, AB 2243 specifies that the use of SDBL incentives, concessions and waivers will not cause the project to be subject to a local discretionary process or subject to CEQA. These revisions apply to both 100% Affordable and Mixed-Income Projects.

e. SB 35 & Coastal Act: AB 2243 incorporates by reference Senate Bill 35’s coastal zone exclusion requirements. The statute now provides that if a site is located within the coastal zone that is not subject to one of the applicable exclusions, the public agency with coastal development permitting authority shall approve a coastal development permit if it determines that the development is consistent with all objective standards of a certified LCP or for areas that are not subject to a LCP, the certified land use plan.

13. Revisions to Key Definitions: In addition to the revisions discussed above, below are additional examples of AB 2243’s revisions to AB 2011’s definitions.

a) “Urban Uses”:For both 100% Affordable and Mixed-Income Projects, AB 2011 requires that at least 75% of the “perimeter of the site adjoins parcels that are developed with urban uses.” AB 2011 previously defined “urban uses” to mean “any current or formal residential, commercial, public institutional, transit or transportation passenger facility, or retail use, or any combination of those uses.” AB 2243 expands this definition to include a “public park that is surrounded by other urban uses, parking lot or structure.”

b) “Neighborhood Plan Area”: For both 100% Affordable and Mixed-Income Projects, AB 2011 required that sites within a “neighborhood plan area” satisfy certain requirements. AB 2243 revises the definition of “neighborhood plan” to add community plans and to require that the plan have been adopted before January 1, 2024, and within 25 years of the date that the project application is submitted. It also further clarifies that a neighborhood plan does not include a plan where the cumulative area covered by the plan is more than one-half of the area of the jurisdiction. This definition applies to both 100% Affordable projects and Mixed-Income projects. AB 2243 also revises the site eligibility criteria for both 100% Affordable and Mixed-Income projects by providing that, for sites within a neighborhood plan area, the plan must permit multifamily housing on the site.